Global Smartphone Shipments Decline, Yet Middle East Sees Growth

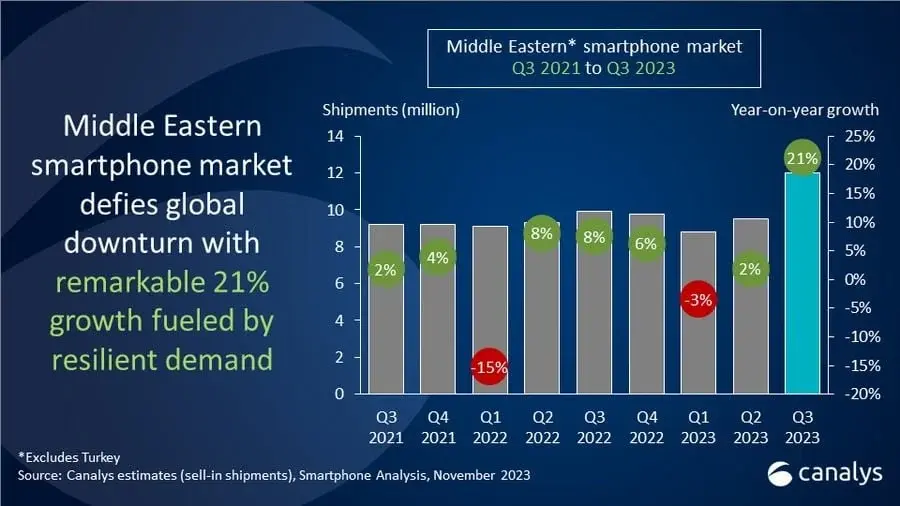

In the current year, there has been a decrease in the volume of smartphones transported globally. Sales of smartphones have experienced a downturn across all significant markets, encompassing North America, Europe, and Southeast Asia. While there's a slight chance of a rise post the ongoing festive sales, the overall year has remained lackluster for global shipments. In a surprising turn of events, the smartphone market in the Middle East has defied the signals of the global smartphone market, marking a substantial 21% yearly growth in Q3 2023.

Details on Smartphone Shipments in the Middle East

According to a recent research report by Canalys, smartphone shipments in Middle Eastern nations (excluding Turkey) have seen a remarkable surge of 21%, amounting to 12.0 million shipments. A surge in business expansion owing to local demand stands as one of the primary factors propelling this growth. Job and business opportunities have seen a remarkable rise in recent times, showing resilience in the face of declining oil prices.

The markets in Iraq and Saudi Arabia have taken off to unprecedented heights, with growth rates of 57% and 46% on a year-over-year basis, respectively. Despite facing certain limitations and challenges concerning importing in US dollars, Iraq has witnessed the most significant growth. In contrast, the market in the United Arab Emirates has only experienced a marginal 2% uptick in shipments, mainly fueled by an increase in tourist arrivals. Both Qatar and Kuwait have shown a slight decline due to subdued demand in these nations.

In Q3 2023, Samsung commands a 31% share of total smartphone shipments, followed by Transsion at 22%, Xiaomi at 15%, Apple at 11%, and Realme in the fifth spot with a mere 4% share.

Preference for Budget Smartphones in the Middle East

Unlike the markets in Southeast Asia, the Middle East displays a stronger inclination towards budget smartphones, typically falling under the sub-$200 category. The majority of sales are driven by Chinese brands like Xiaomi, Transsion, and Honor.

"TRANSSION is steadily expanding its reach in response to the growing mass-market segment amid wider economic uncertainties. Infinix has launched exclusive models in collaboration with Noon in Saudi Arabia, while Tecno has pushed its Camon 20 with enhanced incentives in Iraq. Meanwhile, Xiaomi and HONOR are aiming to break into the premium market with attractive incentives and aggressive promotional strategies, seeking to sway customers from established brands through consistent investment," shares Manish Pravinkumar, a Senior Consultant based in Dubai at Canalys.

Motorola is witnessing a boost in its enterprise business growth within the GCC region. However, Samsung and Apple maintain their positions with robust distribution networks and ecosystem strategies, respectively.

Furthermore, emerging brands are intensifying their marketing efforts to drive sales. While Oppo and Honor are entering the foldable phone market to rival Samsung's dominance, customers in Qatar, Kuwait, and Saudi Arabia may still hesitate to switch brands. Affordability, aspirational value, and product availability will serve as key factors for new players, with initiatives like Buy Now Pay Later gaining ground through platforms such as Tabby and Tamara, proving advantageous for both retailers and consumers, as noted by Pravinkumar.