Meitu Reports Impressive Profit Surge in 2023

Meitu, the Hong Kong-listed tech company, has announced a remarkable increase in profits for the year 2023. The company’s net profit has more than tripled, ranging from an estimated US$46.36 million to US$51.98 million, compared to the previous year. This substantial growth, exceeding 200% compared to 2022, is attributed to the success of Meitu’s new generative AI-based image and productivity tools.

Success of Generative AI Tools

Meitu’s tools, namely “Action” for narrated videos and “X-Design” for creating graphics for product and service posters, have exceeded expectations in terms of user growth and subscription conversion. This ability to monetize generative AI tools sets Meitu apart from major tech companies like Microsoft, Google, and Advanced Micro Devices, which have struggled to turn a profit from their own AI initiatives.

Global Expansion

Meitu’s success has also translated into global expansion, with its products now available in 195 countries and regions. The company has experienced rapid growth in subscribers outside mainland China, marking a significant milestone in its international presence.

Meitu’s Journey

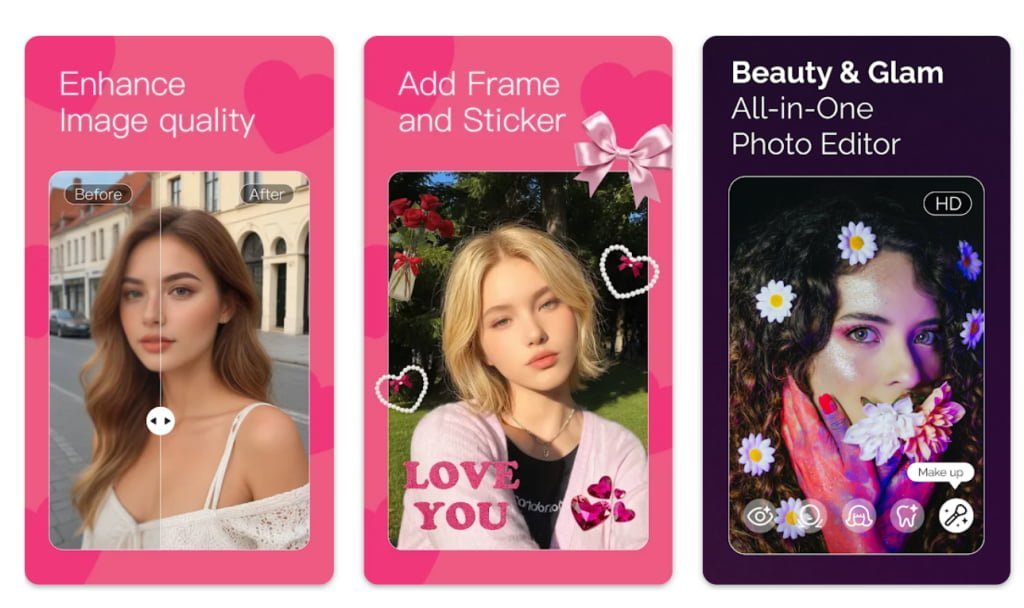

Founded in 2008 in Xiamen, Meitu initially gained success with a selfie app for touch-ups. However, the company faced setbacks with unsuccessful ventures in the smartphone market and social media, as well as significant investments in cryptocurrencies. Despite warnings to investors in July 2022 about potential losses due to cryptocurrency market volatility, Meitu’s recent focus on generative AI has boosted investor confidence, leading to a more than 7% jump in shares upon announcing the 2023 profit estimates.

Shareholder Performance

While Meitu’s shares experienced an 11% pullback recently, shareholders have still seen a 68% increase over the last three years. The company’s quarterly performance saw a 27% drop in share price, causing concerns among investors. However, Meitu’s long-term returns have been significant, outperforming the market by 67% over three years.

CEO’s Commitment to AI

Meitu’s CEO, Wu Xinhong, has emphasized the company’s commitment to understanding AI technology, including employee training programs. The total shareholder return (TSR) for Meitu shareholders over the past year stands at 41%, including dividends, indicating a positive trajectory for the business. As investors navigate the recent pullback, there is a call to examine whether the fundamentals align with the share price and to consider Meitu’s future outlook beyond historical profits.