Key Takeaways

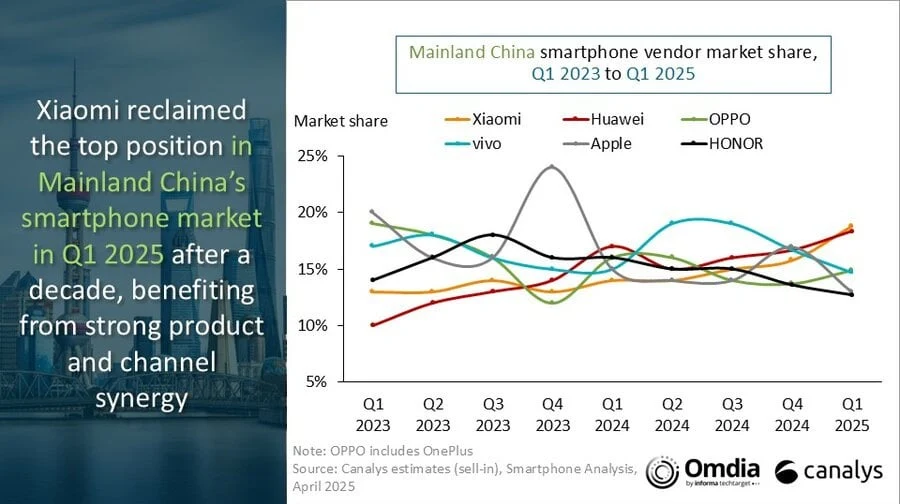

1. Xiaomi regained the leading position in the Chinese smartphone market with 13.3 million shipments and a 19% market share.

2. The company’s success is linked to the synergy between its smartphone division and ecosystem products, along with a unified pricing strategy leveraging government subsidies.

3. Huawei closely follows Xiaomi with 13 million shipments and an 18% market share, supported by investments in foldable devices and its HarmonyOS Next.

4. Oppo and Vivo shipped 10.6 million and 10.4 million units, respectively, while Apple dropped to fifth place with 9.2 million iPhones shipped.

5. The total smartphone shipments in mainland China reached 70.9 million units, showing a 5% increase, influenced by national subsidies and a rebound in consumer sentiment.

For the first time in a decade, Xiaomi has claimed the leading position in the Chinese smartphone market, based on Canalys’ Q1 2025 report. The company shipped 13.3 million smartphones, securing a 19% market share.

Xiaomi’s Strategy

According to Canalys, Xiaomi’s success can be attributed to the synergy between its smartphone division and its broader ecosystem, which includes wearables, personal computers, and even electric vehicles. The company’s unified pricing strategy across both online and offline sales channels has reportedly enabled it to better utilize government subsidies. This approach encourages bundled purchases and makes it easier for consumers to make decisions.

Huawei’s Strong Performance

Huawei was not far behind, managing to ship 13 million smartphones and holding an 18% market share, while also maintaining double-digit growth. The company’s success has been supported by continued investments in foldable devices like the Mate XT and the Pura X, as well as a stronger focus on its HarmonyOS Next. By the end of 2025, this in-house operating system is projected to make up 3% of China’s smartphone install base.

Competitors in the Market

Oppo and Vivo followed, shipping 10.6 million and 10.4 million units, respectively, each capturing a 15% market share. However, only Vivo experienced a slight year-on-year increase in shipments, while Oppo saw a 3% decline in sales. Interestingly, Apple has slipped to fifth place in this ranking, shipping 9.2 million iPhones, which marks an 8% drop compared to the previous year. This decline comes after a seasonal high in Q4 2024 and reveals ongoing difficulties for the brand as the market shifts towards domestic options and budget-friendly strategies.

To sum up, the smartphone market in mainland China showed a modest recovery in Q1 2025, with total shipments reaching 70.9 million units, reflecting a 5% increase from the same time last year. Canalys attributes this growth to national subsidy initiatives and a rebound in consumer sentiment, although analysts believe that much of this increase was artificially accelerated rather than truly organic.

Source:

Link

Leave a Reply