Key Takeaways

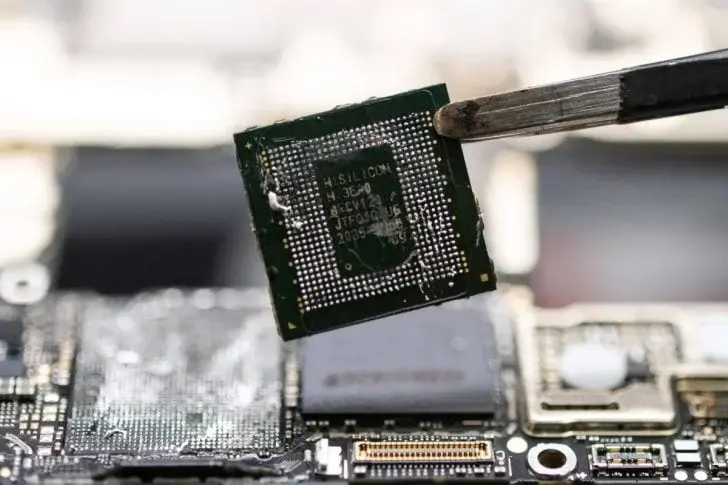

1. SMIC has successfully produced its first 5 nm chip, the Kirin X90 for Huawei, using DUV machines due to trade restrictions on EUV technology.

2. Huawei is researching a 3 nm chip using GAA FET technology, aiming for tape-out by 2026 and mass production by 2027.

3. Yield rates for the 5 nm chip are low at 20%, and the 3 nm chips are expected to have even lower rates due to complex DUV multi-patterning.

4. China is investing in developing its own EUV machines, with reports suggesting Huawei is testing EUV technology for potential mass production by 2026.

5. Advancements in EUV technology are likely to be kept secret, with significant funding of $37 billion allocated for its development.

If the whispers from China are true, SMIC has made a significant breakthrough by producing its first 5 nm chip for Huawei, named the Kirin X90. This accomplishment was achieved without the advanced EUV machines from ASML. Instead, they relied on less powerful DUV machines due to trade limitations. A recent article from UDN sheds light on Huawei’s upcoming strategies regarding its semiconductor sector.

Future Semiconductor Developments

Huawei is now delving into research for a 3 nm node based on GAA FET technology, which they expect to have ready for tape-out around 2026. If everything goes as planned, they aim to kick off mass production by 2027. In addition, there are also investigations into carbon nanotube-based 3 nm chips, though there’s no update on their development status.

Challenges Ahead

Yet, yield rates will remain a concern. The aforementioned 5 nm node reportedly has a low yield rate of just 20%, and this number is expected to decline even further for the 3 nm chips due to the increased complexity of DUV multi-patterning. However, this situation could improve if China manages to transition to EUV technology like TSMC, Samsung, and Intel Foundry.

China is already putting effort into creating its own EUV machines. An X user, @zephyr_z9, who has insights into the Chinese semiconductor industry, notes that Huawei is testing EUV technology, which is anticipated to be ready for mass production by 2026. On the other hand, former ASML engineer @lithos_graphein argues that this is improbable, stating, “ASML’s moat is massive and uncontested.”

Secrecy in Progress

Still, even if China had EUV tools available, they likely wouldn’t make this information public. Reports indicate that $37 billion has been designated for the development of EUV technology, and any advancements will likely be kept secret, similar to what occurred with the Kirin 9010 and its later versions.

Source:

Link