Nvidia, the California-based AI chip giant, has announced a delay in the launch of its highly anticipated China-focused AI chip, H20. Initially slated for release on November 16, the company has pushed the launch to the first quarter of the following year, with insiders suggesting a potential unveiling in February or March. The setback is reportedly linked to challenges faced by server manufacturers in seamlessly integrating the H20 chip into their systems.

Delayed Launch of H20 Chip

Anonymous sources, citing confidentiality concerns, revealed that Nvidia has refrained from commenting on the delay. The H20 chip is part of Nvidia’s strategic move to comply with new U.S. export regulations, reflecting the company’s efforts to maintain a foothold in the Chinese market after facing restrictions on certain product shipments. The delay has resulted in a 1.9% drop in Nvidia’s shares, impacting the market on a shortened U.S. trading day.

Development of L20 and L2 Chips

In addition to H20, Nvidia is concurrently developing two other chips, L20 and L2, designed to adhere to the updated U.S. export rules. While the launch of L20 is reportedly unaffected and proceeding as scheduled, no information is available regarding the status of the L2 chip.

Nvidia’s Alternative Chips for Chinese Customers

Nvidia’s A800 and H800 chips were introduced as alternatives for Chinese customers in November 2022, following the initial ban on exports of advanced microchips and equipment to China. These new chips, including H20, L20, and L2, incorporate Nvidia’s latest AI features, albeit with adjusted computing power to align with the stringent U.S. regulations.

Potential Setback and Competitor Opportunities

The delayed H20 chip launch poses a potential setback for Nvidia, whose GPUs traditionally dominate the AI market. The U.S. export restrictions have opened opportunities for competitors like Huawei to secure orders that might have otherwise gone to Nvidia. Notably, Chinese tech giant Baidu has reportedly placed a substantial order for Huawei AI chips, possibly anticipating future procurement challenges from Nvidia due to U.S. restrictions.

Sales Impact and Future Strategy

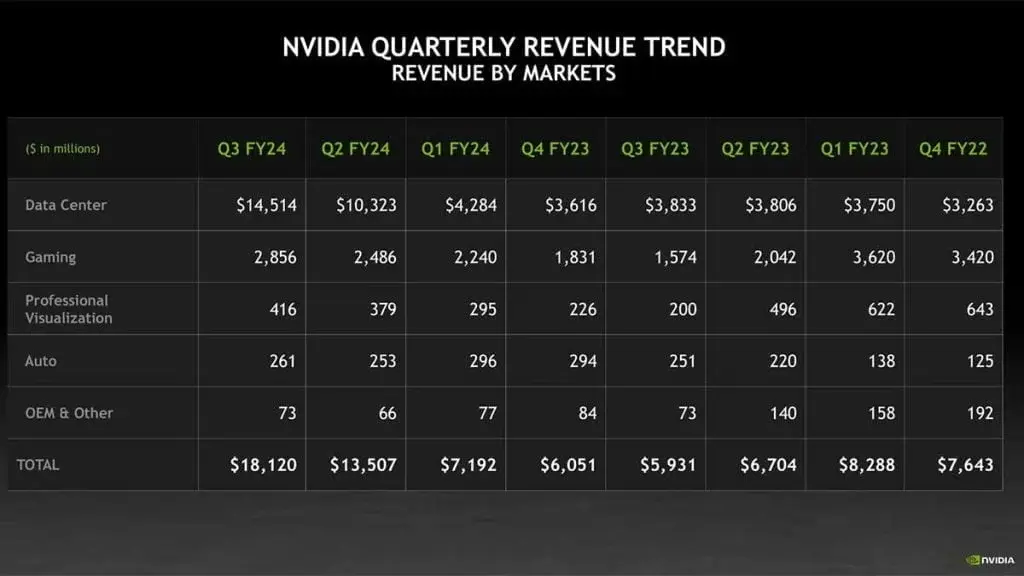

Nvidia, having reported a remarkable tripling of revenue in the September quarter, issued a cautionary note, indicating that sales in regions affected by export restrictions are expected to “decline significantly” in the current quarter. As the company navigates these challenges, the spotlight remains on the forthcoming releases of L20 and L2 chips, which are pivotal to Nvidia’s strategy in adapting to the evolving landscape of U.S.-China trade relations.