Key Takeaways

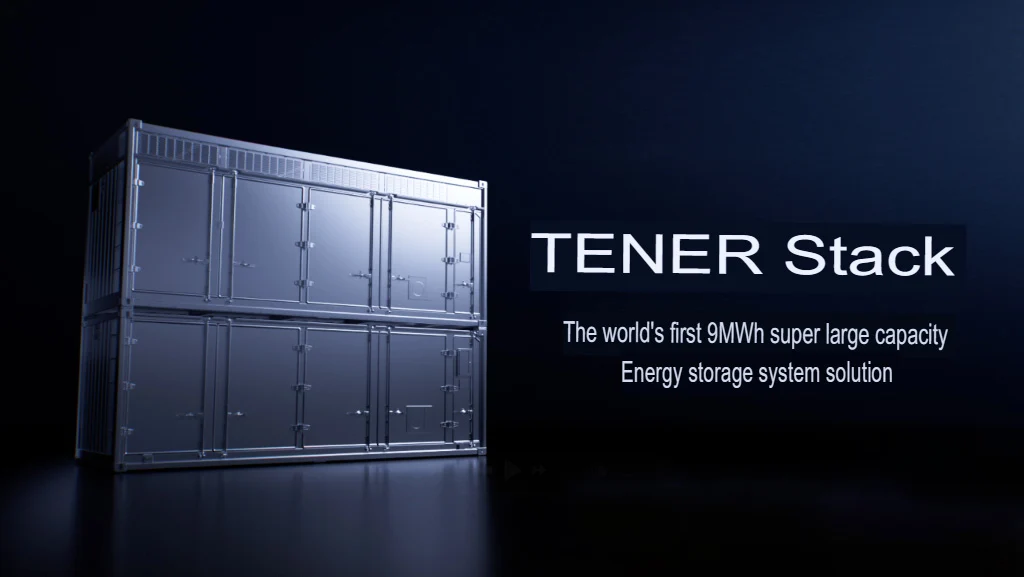

1. CATL has launched the Tener Stack, a 9 MWh energy storage system, enhancing energy density and capacity for large-scale storage solutions.

2. The Tener Stack maintains a zero capacity degradation warranty for the first five years, similar to its predecessor, the 6.25 MWh Tener system.

3. The new system allows for significant space savings, utilizing 45% less space and enabling the creation of a standard grid-level 800 MWh energy storage park with fewer containers.

4. CATL has improved shipping efficiency by reducing costs by 35% through a streamlined loading process and a 2-in-1 design that addresses transportation challenges.

5. Enhanced safety features include advanced thermal management, gas sensors for rapid response to runaway events, and compliance with the IEEE693 standard for earthquake and storm resilience.

Contemporary Amperex Technology Limited (CATL), recognized as the top EV battery producer globally with a 38% market share, continues to enhance and innovate its offerings.

New Innovations in Battery Technology

Following its introduction of the first commercial sodium-ion battery pack for electric vehicles, which boasts a range of over 300 miles per single charge, CATL has now rolled out a pioneering 9 MWh energy storage system (ESS).

The latest Tener Stack solution utilizes CATL’s recent advancements in battery chemistry and packaging, which significantly boosts energy density and capacity, fitting into a standard 20-foot energy storage container.

Previous Milestones

Approximately one year ago, CATL introduced the world’s first mass-produced energy storage solution with a capacity of 6.25 MWh, named Tener. At that time, it featured a 20% reduction in size and a 30% increase in energy density compared to earlier 20-foot energy storage solutions.

With the help of CATL’s solid electrolyte interphase and other cutting-edge technologies, the highly reactive lithium in the LFP batteries is safeguarded against oxidation, which prevents thermal runaway and slows down capacity loss. As a result, CATL was able to offer a 5-year zero degradation and a 20-year overall warranty with the Tener system, a first of its kind.

Introducing Tener Stack

The new energy storage solution, known as Tener Stack, retains the same zero capacity degradation warranty as its 6.25 MWh predecessor.

CATL proudly declares, “This is the world’s first mass-produced 9 MWh ultra-large capacity energy storage system solution,” asserting that the company has made significant advancements in system capacity, safety, deployment flexibility, and transportation efficiency, heralding a new era for large-scale storage technology with the Tener Stack.

With a 9 MWh energy storage capacity, the 20-foot container can supply power to an average single-family home for up to six years, with CATL guaranteeing the cells will not experience capacity degradation for the first five years. Additionally, it has the potential to charge up to 150 electric vehicles, based on the current average battery size. CATL highlighted this capability while showcasing the solution at the Electrical Energy Storage (EES) 2025 expo in Munich, particularly for the typical German household.

Enhanced Design and Efficiency

The Tener Stack system employs LFP battery cells, similar to those found in well-known mobile power stations like Anker’s Solix C1000, which is currently on sale for 50% off at Amazon. In this case, CATL has improved space utilization by 45%, resulting in a 50% increase in energy density compared to traditional 6 MWh energy storage solutions.

This enhancement allows utilities to develop a standard grid-level 800 MWh energy storage park using fewer containers, thus requiring 40% less land for deployment. Moreover, CATL has tackled the logistical difficulties of transporting these heavy LFP battery cells.

The new Tener system has been designed as two identical half-height units, each weighing just under 36 tons, which is the typical legal limit for heavy shipment ground transport. When they arrive, the units can be combined into a 20-foot container, which is reflected in the “2-in-1” design and the name Tener Stack.

Cost-Effective Shipping and Safety Features

CATL has streamlined the loading process by utilizing standard container spreaders and liners, which has reduced shipping costs by 35%. The structural 2-in-1 design also permits the Tener Stack system to be sent to hard-to-reach areas where weight limits for bridges and tunnel heights might be problematic.

As for safety, CATL highlights the leading thermal management of its LFP batteries, alongside new gas sensors that allow for rapid response to runaway events. The upgraded insulation further enhances fire resistance. The system meets the IEEE693 standard, capable of withstanding a magnitude 9 earthquake or a Category 5 storm.

To save space and minimize thermal radiation, the thermal management system is positioned at the top of the container. The resultant noise level is maintained at 65 dB from three feet away, making CATL’s Tener Stack ESS suitable for urban environments as well.

Source:

Link