Samsung and Apple Sales Saga in Europe – Q3 2023

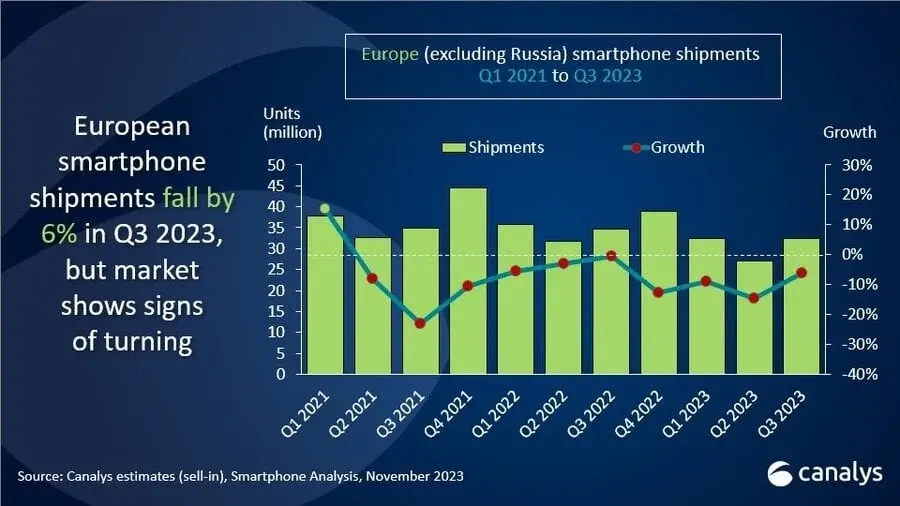

According to a recent report by Canalys, smartphone shipments have seen a continuous decline, but there is hope for a slight increase in demand next year. The decline has been narrowed to 6%, with a total of 32 million shipments in Q3 2023. Despite this decline, Samsung and Apple have managed to retain their top positions in the market, with a market share of 25% and 22% respectively. Additionally, Xiaomi, Motorola, and TCL have seen good sales in the quarter and are expected to experience overall sales growth in Europe.

Challenges for Apple and Samsung

Both Apple and Samsung have faced challenges this quarter. Retailers have been trying to reduce stocks of old smartphones, which has led to a decline in shipments. Samsung attempted to shift its focus from the Galaxy A Series to the more profitable mid-range smartphone, the S Series Flagship, and foldable devices. This strategy has resulted in resilient demand. On the other hand, Apple's USB Type-C cable-led iPhone 15 has seen an increase in shipments by 59%. However, to reduce overstocking of iPhone 14 and older models, retailers temporarily paused shipments, resulting in an overall decrease in shipments in Q3 2023.

Market Share Breakdown

Samsung remains at the top with a 35% overall smartphone market share, while Apple follows closely behind with a 22% market share. Xiaomi has seen strong demand in the mid-range segment with its Redmi Series, capturing 19% of the market share. Motorola and TCL have gained 5% and 3% market share respectively.

Growth in Low-to-Mid-Range Segment

Xiaomi, Motorola, and TCL have registered significant growth in shipments, particularly in the low-to-mid-range segment. Samsung's shift in focus from the low-end to the high-end market has created an opportunity for these OEMs to thrive. Xiaomi has experienced the largest growth, thanks to the sale of its Redmi and Redmi Note 12 models in the Central and Eastern Europe regions. Motorola has also performed well, with a 30% year-on-year increase in shipments.

A Promising 2024 for Smartphone OEMs in Europe

Canalys predicts that the European smartphone market will grow by 4% in 2024. The remainder of this year will be crucial for vendors as they seek to improve their performance in 2023 and start 2024 with positive momentum. It is important for them to clear out channel inventory ahead of new product launches in the first half of 2024. Market experts believe that the European market will see improvements in 2024, driven by the refresh cycle of mid-range devices purchased in 2020 and 2021. Additionally, other factors such as positive market momentum and ongoing festive season discounts are expected to contribute to increased sales in the coming year.

Leave a Reply