Key Takeaways

1. Cost Efficiency: CATL’s sodium-ion batteries are expected to be cheaper to produce than current iron phosphate (LFP) cells when mass production begins.

2. Energy Density Advancements: Sodium-ion cells are approaching energy density levels comparable to LFP batteries, overcoming a key barrier to their broader adoption.

3. Positive Market Outlook: The launch of the first sodium-ion power bank indicates a favorable trend for increased adoption of this technology and competitive pricing.

4. Cautious Commercialization: CATL takes a conservative approach to commercialization, focusing on viable mass production rather than high-priced niche products.

5. Solid-State Battery Timeline: CATL has experience in solid-state batteries but predicts widespread use won’t occur until after 2027, reflecting their cautious strategy.

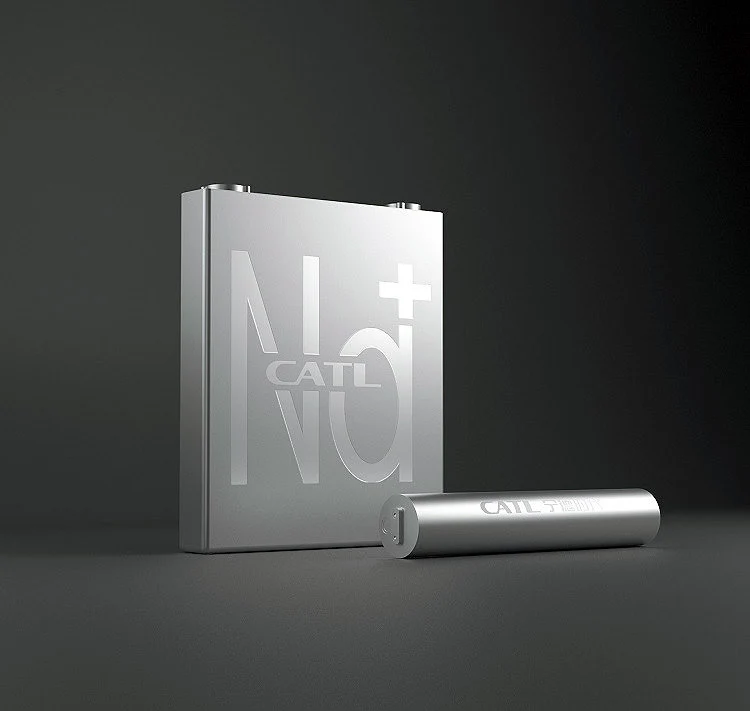

At a recent quarterly meeting with investors, Contemporary Amperex Technology Co. Ltd. (CATL), recognized as the largest battery manufacturer in the world, provided insight into its plans for sodium-ion cell production.

Cost Efficiency in Production

When CATL’s second generation of sodium-ion batteries is fully ramped up for mass production, the expenses involved will be significantly reduced compared to the current most economical battery type, which is the iron phosphate (LFP) cells.

Advancements in Energy Density

An even more crucial point in CATL’s sodium-ion battery progress update is the assertion that its sodium-ion cells are nearing the energy density levels of the common LFP battery technology, which is dominant in both 200W power banks and mainstream electric vehicles. This was previously the central barrier to broader sodium-ion battery adoption, as these batteries have mostly been utilized for proof-of-concept electric vehicles or energy storage projects that don’t demand high energy densities.

Positive Outlook for Mass Adoption

The recent introduction of the first sodium-ion power bank suggests a positive outlook for the widespread use of this technology. If CATL, the world’s leading battery producer, is making advancements in its development, then competitive pricing should follow soon after.

CATL’s sodium-ion battery update is quite a notable advancement, not just because it claims that producing cells without lithium will be cheaper than LFP technology, but also because it believes that mass production is unavoidable. They stated, “once large-scale adoption is achieved, sodium-ion batteries will have a certain cost advantage over LFP batteries.”

CATL’s Conservative Approach

CATL has reached the top of the battery industry by being cautious with its commercialization predictions of new technologies. Unlike smaller startups striving for breakthroughs in solid-state or sodium-ion batteries that lead to high-priced and niche products, CATL prioritizes the mass production viability of new battery chemistries or packaging technologies.

When NIO requested a collaboration on its battery utilizing 95% solid electrolyte, CATL dismissed the idea, citing the resources needed to fulfill existing orders for its numerous clients. NIO subsequently developed a 150 kWh semi-solid-state battery for its ET7 sedan with a startup, but CATL was correct in predicting that the battery became too costly, and now NIO is leasing it for extended summer journeys.

Cautious Optimism for Solid-State Batteries

This is not to imply that CATL lacks experience in solid-state battery development; they have a decade of work in this area. However, the company warns that widespread use won’t occur until after 2027. This is sooner than their earlier 2030 estimate, but CATL tends to prioritize caution, and a similar strategy appears to be in effect with their sodium-ion battery technology.

Despite CATL’s sodium-ion battery energy density apparently nearing that of LFP batteries, the company seems to be taking a deliberate approach to refine the chemistry while considering what will be practical for low-cost mass production.

Source:

Link

Leave a Reply