Key Takeaways

1. SMIC expects a revenue dip of up to 6% in Q2 due to equipment maintenance disruptions.

2. U.S. export restrictions have forced unqualified SMIC engineers to manage advanced tool maintenance, increasing risk of further disruptions.

3. In Q1 2025, SMIC reported $2.247 billion in revenue, a 1.8% increase, primarily driven by wafer sales.

4. Equipment issues have diverted $30 million to $75 million from R&D, but SMIC maintains a $7.5 billion capital expenditure plan.

5. Co-CEO Haijun Zhao noted that tariff impacts on revenue are minimal, but increasing prices may affect demand later in the year.

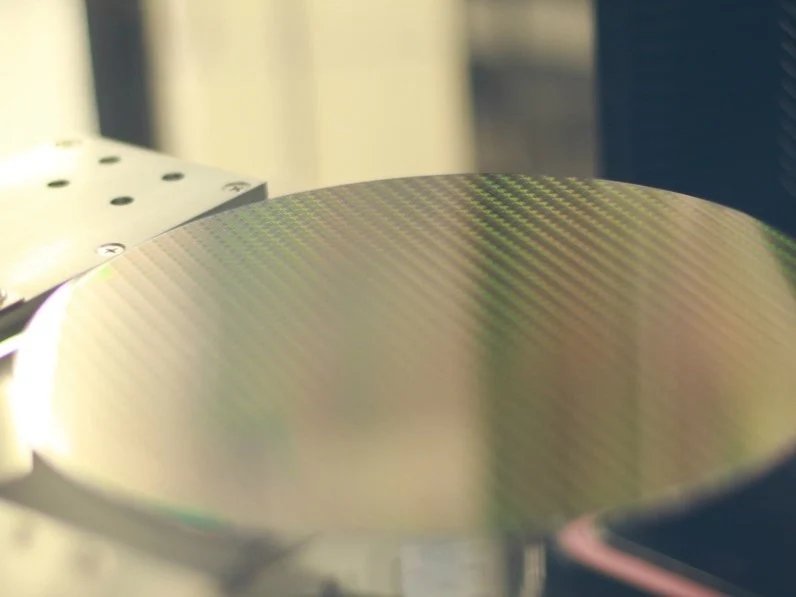

Semiconductor Manufacturing International Corporation (SMIC) is expecting a revenue dip of up to six percent for the second quarter due to disruptions from equipment maintenance and validation. A mishap during their annual maintenance, along with problems found in newly set up tools, has led to a decrease in sellable output, without affecting the average selling prices.

Maintenance Challenges

U.S. export restrictions preventing American suppliers from servicing advanced wafer fabrication tools in China have compelled SMIC engineers, who don’t have formal qualifications for some tasks, to handle maintenance themselves. This situation raises the risk of further disruptions and could lead to lower yield quality.

First Quarter Performance

In the first quarter of 2025, SMIC reported revenue of $2.247 billion, reflecting a 1.8 percent increase from the previous quarter. Wafer sales made up 95.2 percent of this total, thanks to an 18 percent rise in shipments of 200-millimeter wafers and a two percent growth in 300-millimeter volumes. Factory utilization increased to 89.6 percent, helping to mitigate the effects of lower unit prices and rising depreciation costs on profit margins.

Financial Implications

Addressing the issues with the faulty equipment has already redirected between $30 million and $75 million from research and development. Nevertheless, management is sticking to a bold $7.5 billion capital-expenditure plan for the year. Executives believe the current impact of tariffs is “minor,” although they admit that increased prices downstream might limit demand in the latter half of the year.

Co-CEO Haijun Zhao mentioned that close collaboration with partners and received tariff exemptions have helped to keep the direct revenue impact from trade policies below one percent. The company is still closely watching customer demand due to the ongoing geopolitical uncertainties.

Source:

Link