Key Takeaways

1. Slate Auto announced an electric pickup that can transform into a two-door SUV, initially priced under $20,000.

2. Production of the Slate truck is scheduled for 2026, but the $7,500 federal EV tax credit will expire in September 2025.

3. The company has updated its expected price to the mid-$20,000 range due to the loss of the tax credit.

4. Slate Auto faces challenges in reducing costs, as the current battery size and range limitations hinder further cuts.

5. Despite challenges, Slate Auto received over 100,000 reservations in two weeks, but conversion to actual sales is uncertain without the tax incentive.

A few months back, there was a big media push from Jeff Bezos’ Slate Auto, which promised an electric pickup that could easily change into a two-door SUV. The standout feature was its price, which was advertised to be under $20,000. However, that now seems quite unlikely due to a new legislation.

Production Timeline

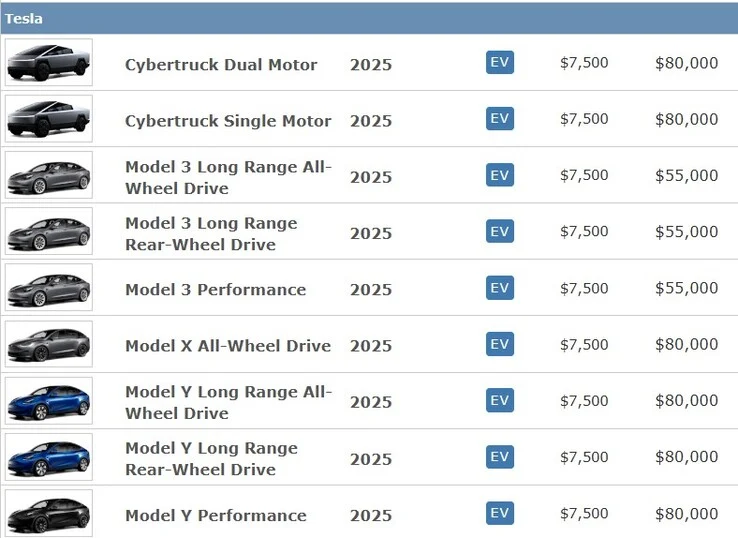

The Slate truck is set to begin production in 2026, but that timing is unfortunate since the $7,500 tax credit will end in September 2025. The spending bill was signed into law by President Donald Trump in early July, effectively putting a stop to a federal incentive that aided many Americans in purchasing electric vehicles and allowed companies like Tesla and Rivian to become worth billions.

Changes in Pricing

In response, Slate Auto quickly updated its website, removing any mention of the federal EV tax credit. The new wording states, “Expected Price: Mid-Twenties.”

While the fresh EV maker has not yet revealed the actual price of its electric pickup, it was aiming for a basic model to keep the starting cost in the mid-$20,000 range, which was supposed to drop below $20,000 with the tax credit in place.

Challenges Ahead

Slate will face challenges in reducing costs further. For example, cutting down the battery size isn’t a viable option as the entry-level 52.7 kWh battery already offers a rather lackluster range of 150 miles. Plus, the charging speed isn’t very impressive, maxing out at 120 kW. There’s also no center display to remove to save on costs.

Despite these challenges, the EV startup claims to have garnered over 100,000 reservations within just two weeks. However, only time will tell how many of these reservations will convert into actual deliveries without the federal EV tax credit in play.

Source:

Link