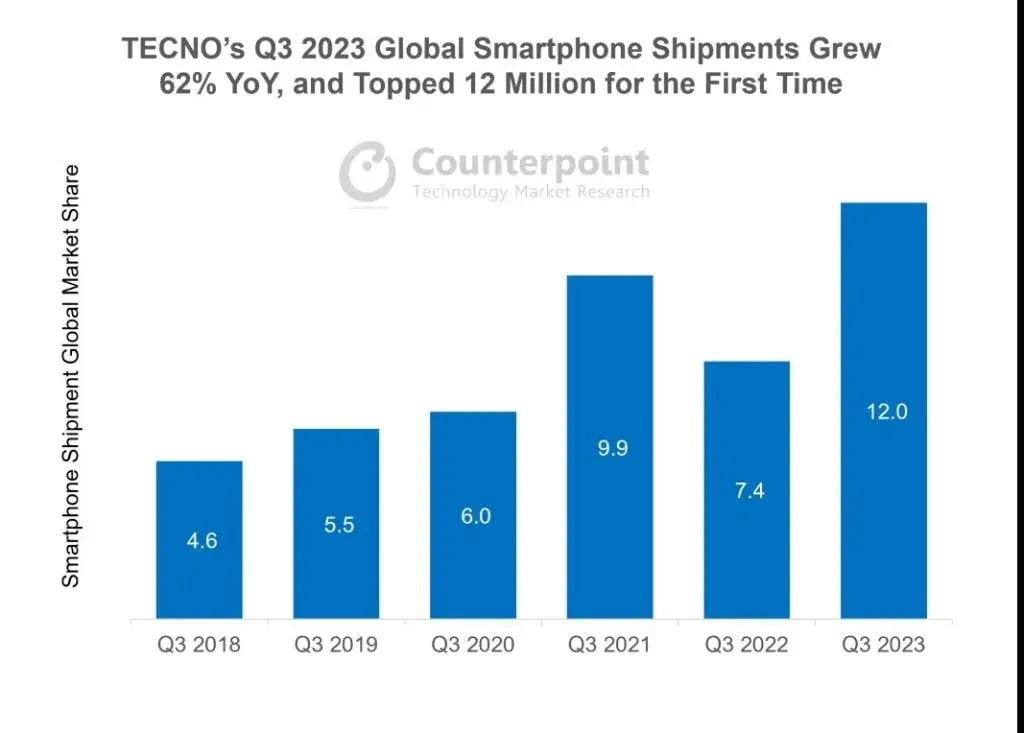

According to Counterpoint's Market Monitor service, TECNO, the biggest brand in Transsion's family, experienced a significant growth in smartphone shipments across all regions in Q3 2023. The shipments increased by an impressive 62% YoY, contributing to Transsion's overall results with a 36% YoY increase in smartphone shipments for the quarter.

TECNO's remarkable growth has led to the brand becoming the world's 9th largest smartphone brand, capturing 4% of the global smartphone market in Q3 2023. This achievement is particularly noteworthy as TECNO's market share has more than tripled in just three years. It has also propelled Transsion to become one of the top 5 smartphone original equipment manufacturers (OEMs) globally.

The growth in TECNO's shipments can be attributed to an improvement in product mix. The brand has expanded the proportion of higher-value devices sold, indicating a shift towards more premium offerings. According to Counterpoint's Global Handset Model Sales service, almost all TECNO smartphones now come equipped with 4G or 5G connectivity. The introduction of 5G smartphones in Q1 2022 has led to a rapid increase in volume, with shipments growing by over 600% YoY by Q3 2023.

Furthermore, TECNO has witnessed a significant increase in sales volume for its high-end CAMON series and premium-end PHANTOM series, surpassing the company's overall growth rates with a 53% YoY increase. The PHANTOM series, in particular, has seen a remarkable rise in popularity, now accounting for nearly 5% of TECNO's global sales. This growth is a positive indication that TECNO's efforts to compete in the mainstream global smartphone industry are paying off, as the brand gains acceptance among consumers outside of Africa.

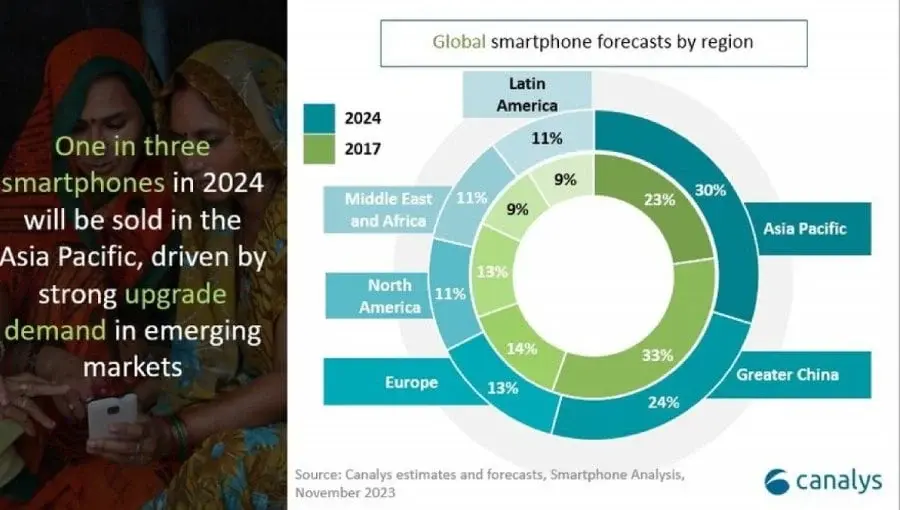

Looking ahead, the growth trajectory for TECNO appears favorable due to various megatrends. Factors such as urbanization, the rapid development of connectivity infrastructure, the migration from feature phones to smartphones, the availability of cheaper components, and the increasing adoption of digital services are expected to gather pace. These trends provide a promising outlook for TECNO's future growth.

Overall, TECNO's impressive performance in Q3 2023 showcases its ability to expand its market share and offer competitive smartphones with advanced connectivity options. The brand's success not only solidifies its position within Transsion's family but also establishes it as a significant player in the global smartphone market.