Key Takeaways

1. Zhao Weiguo, former chairman of Tsinghua Unigroup, received a death penalty with a two-year delay, likely resulting in life imprisonment due to serious misconduct impacting national interests.

2. His wrongdoings included diverting state assets worth around 470 million yuan and causing losses of nearly 890 million yuan to a subsidiary.

3. Despite his criminal actions, Zhao showed remorse and attempted to return some profits, influencing the court’s decision for a suspended sentence.

4. Zhao played a key role in making Tsinghua Unigroup a leader in semiconductors but faced downfall after the company defaulted on $31 billion in debts.

5. His conviction is part of a broader trend of investigations into individuals in China’s semiconductor sector, with future state assistance expected to involve stricter oversight.

The Intermediate People’s Court in Jilin has given former chairman of Tsinghua Unigroup, Zhao Weiguo, a death penalty with a two-year delay, which usually turns into life in prison. As reported by state broadcaster CCTV, the court determined that Zhao’s wrongdoings were “extremely huge” and greatly harmful to national interests.

Details of the Case

Prosecutors laid out a clear pattern of misconduct: directing profitable contracts to family and friends, diverting state assets valued at around 470 million yuan (approximately $65 million) into private ownership, and burdening a listed subsidiary with deals that led to the state facing losses nearing 890 million yuan (around $124 million). Zhao confessed to his wrongdoings, showed remorse, and attempted to return some of the ill-gotten profits. These elements influenced the court’s decision to impose a suspended sentence rather than immediate execution.

Zhao’s Background

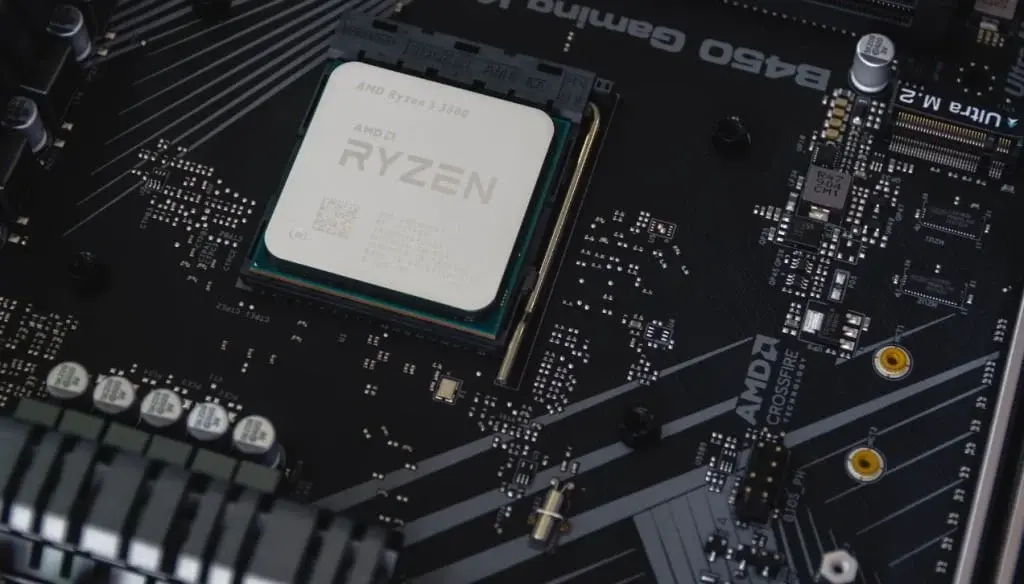

Zhao became involved with Tsinghua Unigroup in the 1990s and later initiated an aggressive strategy for acquisitions that temporarily turned the firm into a national leader in semiconductors. The company owned assets like mobile-chip designer Unisoc and NAND producer YMTC. This expansion was supported by government financing and extensive bond sales, which aligned Unigroup with Beijing’s “Made in China 2025” initiative aimed at achieving chip self-sufficiency.

The Downfall

However, the strategy fell apart when the group defaulted on bond repayments in 2020, accumulating debts estimated at about $31 billion. A restructuring led by the court in 2022 removed both Zhao and the original shareholders of the company—Tsinghua University and a Zhao-controlled entity—in favor of a consortium supported by state venture capital.

Zhao’s conviction is part of a series of recent investigations into prominent individuals involved in China’s semiconductor efforts. Following years of significant investment—and some notable failures—officials are indicating that future state assistance will be accompanied by much stricter oversight.

Source:

Link