Key Takeaways

1. The ThinkStation P3 Tiny Gen 2 features upgraded hardware with Intel’s new Arrow Lake processors, offering nearly twelve processor options.

2. Customization includes Nvidia RTX A400 or RTX A1000 GPUs, with the A1000 providing double the VRAM (8 GB) compared to the A400.

3. Enhanced storage capabilities include two CSODIMM slots and multiple M.2 slots for PCIe SSDs.

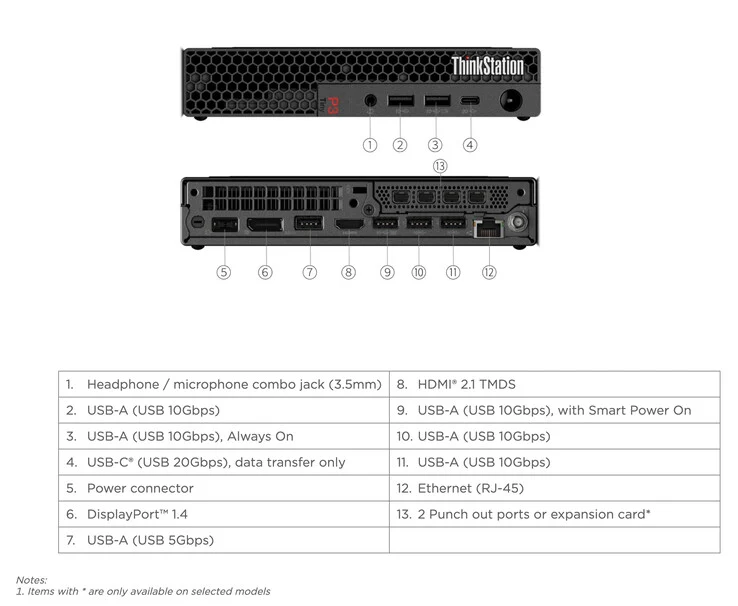

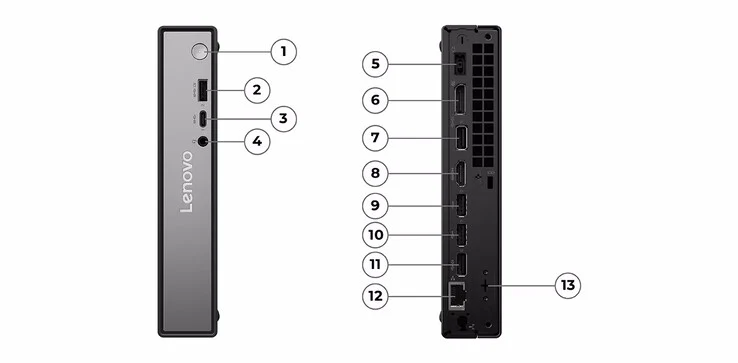

4. Connectivity options feature HDMI 2.1, USB Type-A, USB Type-C (20 Gbps), and Gigabit Ethernet, with several Type-A ports supporting up to 10 Gbps speeds.

5. The desktop is compatible with multiple operating systems and is expected to be released in select markets later this month; pricing is still pending.

Lenovo has made a subtle upgrade to its ThinkStation P3 Tiny desktop by introducing a second-generation model. Just to remind you, the first generation was launched in May 2023 and is currently priced at $949.99 on Amazon. Although it was considered quite powerful back then, with its Intel Core i9-13900 processor and Nvidia T1000 graphics card, these components have now been outperformed by newer and stronger options.

Enhanced Performance Options

Notably, the ThinkStation P3 Tiny Gen 2 offers configurations with much more robust hardware compared to the original model. Lenovo has transitioned from Intel’s Raptor Lake processors to the new Arrow Lake series, providing nearly twelve processor choices. According to Lenovo’s PSREF site, you can select from the Core Ultra 5 225 up to the Core Ultra 9 285, all utilizing Intel’s LGA 1851 socket and compatible with LPDDR5-6400 RAM.

Graphics and Storage Improvements

In addition, the Gen 2 version can be customized with Nvidia’s RTX A400 or RTX A1000 laptop GPUs. Both graphics cards come equipped with four miniDP 1.4a connectors, a single slot design, and a 50 W TGP. However, the RTX A1000 boasts double the GDDR6 VRAM of the A400, totaling 8 GB. Furthermore, Lenovo has indicated that the desktop includes two CSODIMM slots, a PCIe 5.0 M.2 slot, and two more M.2 slots that can handle PCIe 4.0 SSDs.

Connectivity and Availability

The ThinkStation P3 Tiny Gen 2 is also equipped with various ports, including HDMI 2.1, USB Type-A, USB Type-C (20 Gbps), and Gigabit Ethernet. Out of the six Type-A ports available, five can achieve transfer speeds of up to 10 Gbps. Additionally, the new desktop is compatible with operating systems like Ubuntu, Red Hat Enterprise Linux 9.6, and both Home and Pro editions of Windows 11. Lenovo hints that the ThinkStation P3 Tiny Gen 2 might be released later this month in select markets. While pricing details are not yet available, you can find more information about the ThinkStation P3 Tiny Gen 2 on Lenovo’s website.

Source:

Link