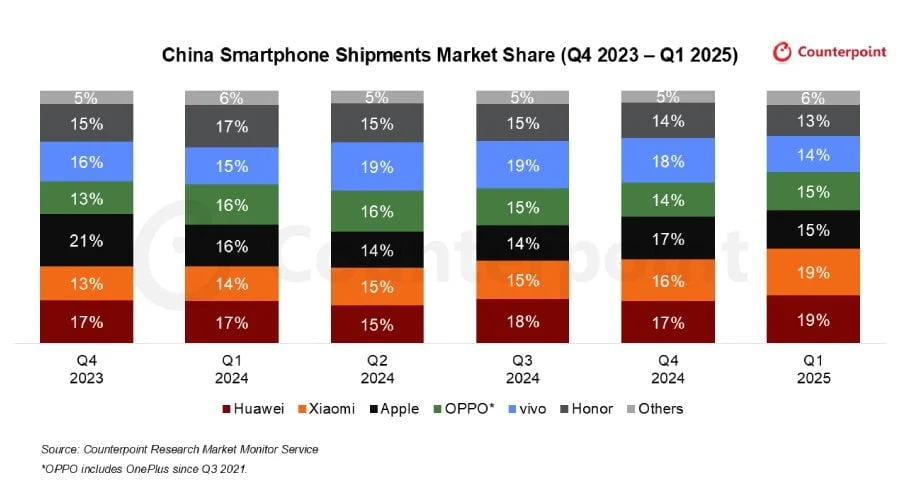

Key Takeaways

1. Huawei leads the Chinese smartphone market with a 19% share in Q1 2025, surpassing competitors.

2. China’s smartphone market grew by 5% year over year, driven by a government subsidy initiative, but growth slowed post-holiday.

3. Xiaomi matched Huawei’s market share at 19%, with a 3% quarter-over-quarter increase.

4. Apple fell to third place with a decline in market share from 17% to 15%, affected by the subsidy program’s price limitations.

5. Oppo and Honor ranked fourth and sixth, with market shares of 15% and 13%, respectively; growth in the market is expected to continue but at a slower pace in 2025.

Counterpoint has released its newest report on smartphone shipments in China, revealing that Huawei has secured the top position, surpassing all competitors to achieve the No. 1 rank in Q1 2025.

Market Growth Insights

China’s smartphone market experienced a 5 percent increase year over year, largely due to a government subsidy initiative that started in January. However, this initial surge in demand didn’t persist. Counterpoint notes that interest waned after the holiday period, leading to growth that still fell below what was anticipated.

Huawei’s Performance

Huawei managed to capture a 19 percent share of the market this quarter, marking a 2 percent rise from Q4 2024. Xiaomi matched Huawei’s share at 19 percent but recorded a slightly higher quarter-over-quarter increase of 3 percent.

Apple dropped to third place, with its shipments declining by 2 percent, which reduced its share from 17 percent to 15 percent. Counterpoint suggests that this decrease is linked to the nature of the government subsidy program, which only applies to phones priced over CNY 6,000 (around $820). Many iPhones, especially the popular Pro models, are priced well above this limit, making them ineligible for discounts.

Other Brands in the Market

Oppo secured the fourth position with a 15 percent market share and a modest growth of 1 percent. Vivo experienced a notable decrease, dropping from 18 percent to 14 percent compared to the previous quarter. Honor followed closely behind in sixth place, holding a 13 percent share.

Looking forward, Counterpoint anticipates that the Chinese smartphone market will keep growing year over year in 2025, albeit at a slower rate. The upcoming launches of new devices in Q2 and mid-year sales events are expected to provide a temporary uplift in shipments.