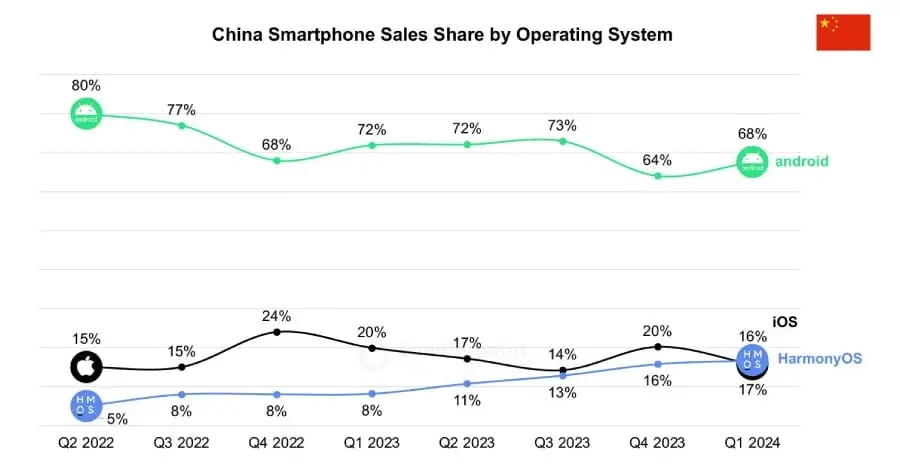

Huawei’s HarmonyOS operating system has marked a significant achievement in the Chinese market, as per data from Counterpoint Research. In the first quarter of 2024, HarmonyOS overtook Apple’s iOS for the first time, becoming the second-most popular mobile operating system in China.

Market Share Surge

The report indicates a notable rise in HarmonyOS’s market share, which increased from 8% in Q1 2023 to 17% in Q1 2024. Concurrently, iOS’s share dropped from 20% to 16%.

This marks the first instance since Q1 2019 that iOS has experienced a reduction in market share during the first quarter in China. The decline is partly attributed to the release of new 5G smartphones by Huawei, which pose direct competition to Apple’s offerings.

Global Expansion

HarmonyOS’s growth extends beyond China. Globally, its market share doubled year-on-year, reaching 4% in Q1 2024. In contrast, both Android and iOS experienced minor drops from 78% and 20% in Q1 2023 to 77% and 19%, respectively.

Despite this, Android saw a month-on-month recovery in Q1 2024, while iOS’s share fell from 23% in Q4 2023 to 19% in Q1 2024. Counterpoint attributes this decline to the seasonal variations typical of iPhone releases.

5G Adoption and Future Trends

HarmonyOS is witnessing strong 5G adoption. According to Counterpoint, the adoption rate increased from 9% in Q1 2023 to 50% in the first quarter of this year. The report also indicates that Huawei’s focus on localizing its supply chain is expected to sustain this growth trend.

Counterpoint’s findings are consistent with a forecast report by TechInsights released in January 2024, which predicted that HarmonyOS would surpass iOS to become the second-largest smartphone operating system in China by year-end.