The Importance of Semiconductor Manufacturing in a Technology-Driven World

In today’s technology-driven world, the production and control of semiconductor chips have become increasingly vital. Jensen Huang, the CEO of Nvidia, a leading player in the semiconductor industry, recently emphasized the significant amount of time the United States may need to achieve self-reliance in chip manufacturing. According to Huang, the US could be a decade or two away from reaching this crucial milestone.

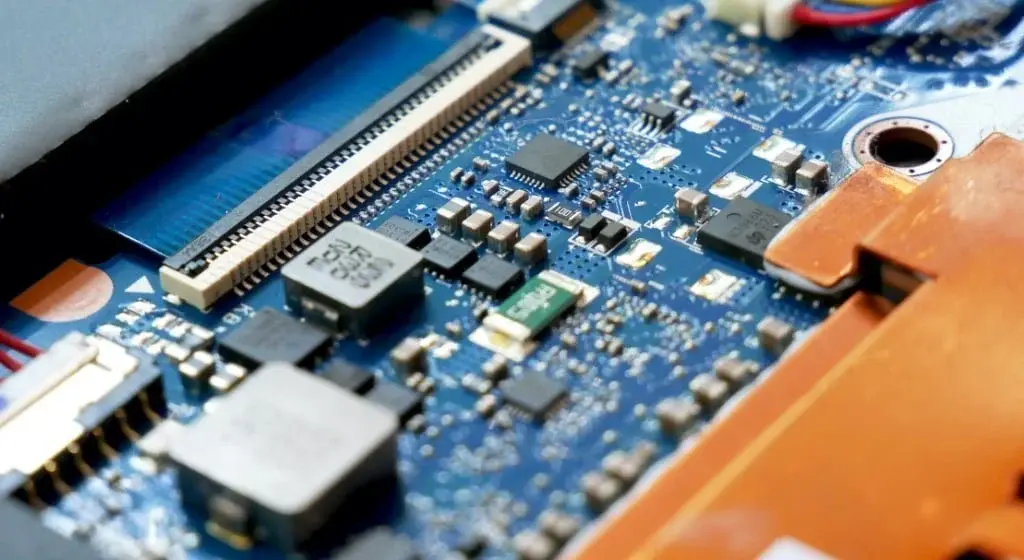

The Global Significance of Semiconductors

The semiconductor industry is a complex and globally interconnected web, with significant components originating from various parts of the world, notably Taiwan. The current geopolitical climate, marked by tensions in US-China relations, has intensified the focus on semiconductor production. To address this, the US government has been making efforts to bolster domestic manufacturing capabilities. President Biden’s visit to a new Taiwanese chip-making plant in Arizona is a clear example of these efforts, reflecting a growing desire to mitigate reliance on foreign production.

A Global Movement Towards Localization

However, the shift towards domestic production is not exclusive to the United States. Europe, too, is striving to localize semiconductor manufacturing. This global movement signifies a departure from decades of globalization that distributed production across the world, creating vulnerability through concentrated production hubs in places like Taiwan and South Korea.

The National Security Factor

The strategic importance of the semiconductor industry goes beyond economic factors; it also extends to national security. This is evident in the US government’s recent export restrictions on high-end artificial intelligence processors to China, impacting companies like Nvidia. These restrictions are part of broader efforts to safeguard national security and maintain technological competitiveness.

Balancing Regulatory Compliance and Market Presence

Jensen Huang’s comments also shed light on the delicate balance that companies like Nvidia must maintain. While adhering to US regulations, they also need to sustain their market presence in China, which happens to be the world’s largest chip market. Adapting to regulatory changes and developing new, compliant products are crucial for these companies to continue their global operations.

In conclusion, the production and control of semiconductor chips have become increasingly important in today’s technology-driven world. Achieving self-reliance in chip manufacturing is a significant goal for countries like the United States and Europe. Moreover, the strategic importance of the semiconductor industry extends beyond economic factors, encompassing national security considerations. Companies like Nvidia face the challenge of balancing regulatory compliance and maintaining their market presence in the face of evolving geopolitical dynamics. As the world becomes more dependent on technology, the semiconductor industry will continue to play a crucial role in shaping the global landscape.