Key Takeaways

1. SiCarrier, referred to as the “Chinese ASML,” is seeking $2.8 billion in external fundraising, aiming for an $11 billion valuation to reduce reliance on imported chip-manufacturing equipment.

2. The Shenzhen local government plans to sell about 25% of a SiCarrier subsidiary, potentially valuing it at 80 billion yuan, with proceeds focused on research and development.

3. Founded in 2021, SiCarrier specializes in first-generation technology and aims to provide various semiconductor manufacturing tools, showcased at SEMICON China.

4. Analysts note that many of SiCarrier’s products are still in development and lack the validation needed for semiconductor clients, raising concerns about the speed of monetization.

5. SiCarrier faces challenges from U.S. export regulations and restrictions, which complicate access to foreign technologies and emphasize China’s push for self-sufficiency in the semiconductor industry.

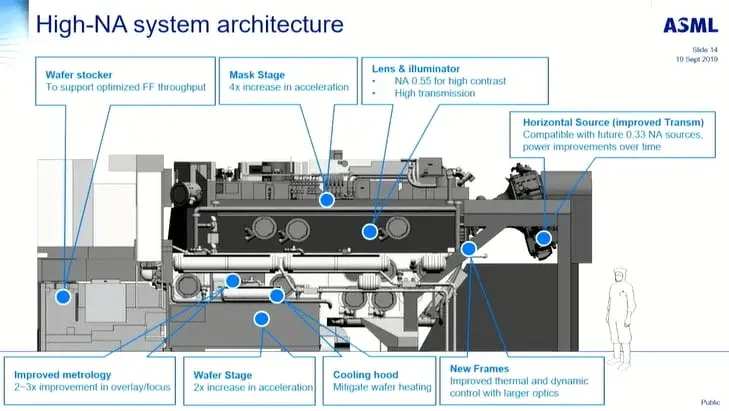

Shenzhen’s SiCarrier, often called the “Chinese ASML,” is gearing up for its first round of external fundraising, aiming to gather about $2.8 billion while being valued at around $11 billion. This fundraising initiative is part of a larger strategy by China’s semiconductor industry to reduce dependence on imported chip-manufacturing equipment.

Sale of Subsidiary Stakes

Sources close to the situation indicate that the Shenzhen local government plans to sell roughly 25 percent of a SiCarrier subsidiary, which does not possess lithography assets. This sale could value the unit at approximately 80 billion yuan (around $11.1 billion) and might be finalized within a few weeks, potentially becoming one of the largest yuan-denominated fundraising efforts in the country this year. The funds raised will primarily be used for research and development, and several state-owned enterprises along with local venture capitalists have expressed interest.

Company Background and Goals

Founded in 2021, SiCarrier operates as a wholly-owned subsidiary of the Shenzhen State-owned Assets Supervision and Administration Commission. The firm focuses on “first-generation technology, materials, and equipment,” with a core team that has over twenty years of experience in electronic equipment engineering. Its public documents outline a product roadmap that includes etching, diffusion, thin-film deposition, and metrology tools, which are aimed at prominent fabs and research institutions in China.

The extensive product roadmap was showcased at SEMICON China in March, where SiCarrier presented 31 tools categorized into six groups, each named after well-known Chinese mountains. The categories include epitaxial deposition (Emei Series), atomic-layer deposition (Ali Series), physical vapor deposition (Putuo Series), etching (Wuyi Series), chemical vapor deposition (Changbai Series), and various measurement platforms. Domestic analysts praised this reveal as a significant milestone for Chinese chip equipment manufacturers.

Challenges Ahead

Despite the excitement, independent assessments suggest that most of the machines introduced are still in the development stage and have not yet undergone the extensive validation that semiconductor clients typically require. Bernstein Research and industry experts warn that constructing and certifying complex wafer-fab machinery generally takes many years, leading to doubts about how swiftly SiCarrier can monetize its product line.

SiCarrier’s growth ambitions are set against a backdrop of stringent U.S. export regulations. The company was added to an American entity list late last year due to suspected connections with Huawei, which both firms deny. These restrictions have hindered access to foreign technologies and have heightened China’s urgency for self-sufficiency. While it’s still unclear if SiCarrier can expand rapidly enough to compete with established international suppliers, its forthcoming capital raise indicates that China is willing to make significant investments to bridge that gap.

Source:

Link