Key Takeaways

1. TSMC’s N2 node is in high demand from major companies like AMD, Nvidia, Apple, and Qualcomm, leading to higher pricing for wafers.

2. Wafer prices are expected to rise further due to construction costs of fabs, economic uncertainty, and TSMC’s need to recover significant investments.

3. The cost of TSMC’s 2 nm wafers is projected to increase by 10%, potentially reaching around $33,000 for a 300 mm wafer.

4. Smaller OEMs might shift to older nodes (N3, N4) or consider Samsung Foundry’s 2 nm options due to rising TSMC prices.

5. Intel’s innovative 18A and 14A nodes are becoming competitive alternatives, featuring technologies not available from TSMC and Samsung Foundry for several years.

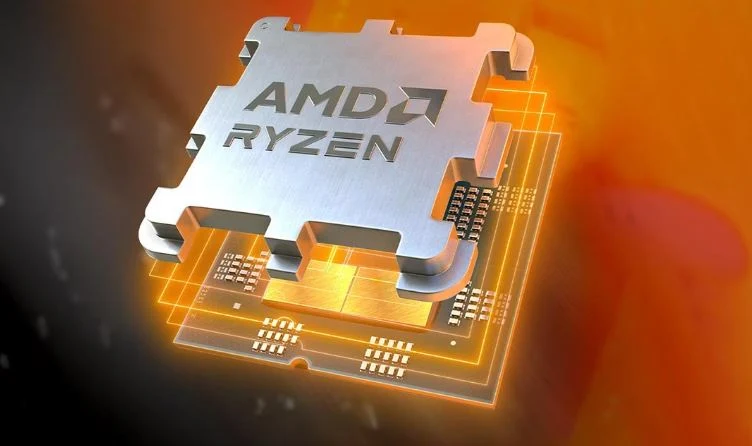

With the increasing demand from companies like AMD, Nvidia, Apple, Qualcomm, and even Intel, which has its own fabrication plants, TSMC’s N2 node is becoming one of the most wanted in recent times. This high demand allows the Taiwanese semiconductor manufacturer to set higher prices.

Rising Wafer Prices

A new report from Ctee suggests that wafer prices might rise even further in the upcoming weeks. Insiders believe this is due to the increasing expenses of constructing fabs in countries like the United States, the overall uncertainty in the global economy, and the need to recover some of the $38-42 billion that TSMC intends to invest this year for capital projects.

Cost of TSMC’s 2 nm Wafers

A wafer at TSMC’s 2 nm node is expected to be 10% pricier than previously. Last year, the estimated cost was around $30,000 for a 300 mm wafer, which means the new price could reach about $33,000. The report mentions that Nvidia’s CEO, Jensen Huang, finds TSMC’s advanced nodes to be “very worth it.”

Nvidia plans to use the N2 node for its upcoming Rubin Next architecture. It will also be utilized in AMD’s Zen 6 processors, Apple’s A21 and M5 chips, MediaTek’s Dimensity SoC, and potentially even in the CPU tile of Intel’s Nova Lake desktop series.

Smaller OEMs and Alternatives

This situation might lead many smaller OEMs to consider older options like the N3 and N4 nodes. Alternatively, they may explore Samsung Foundry’s 2 nm offerings (SF2/SF2P), which Qualcomm is reportedly looking into. If TSMC’s wafer prices continue to escalate, Samsung Foundry could have a genuine opportunity for a resurgence, assuming they can stabilize their yields.

Intel’s 18A and 14A nodes are also becoming strong contenders due to their innovative technology like backside power delivery, which TSMC and Samsung Foundry won’t have access to for a few more years.

Source:

Link