US Allocates $3.5 Billion to Expand Domestic Battery Processing Facilities

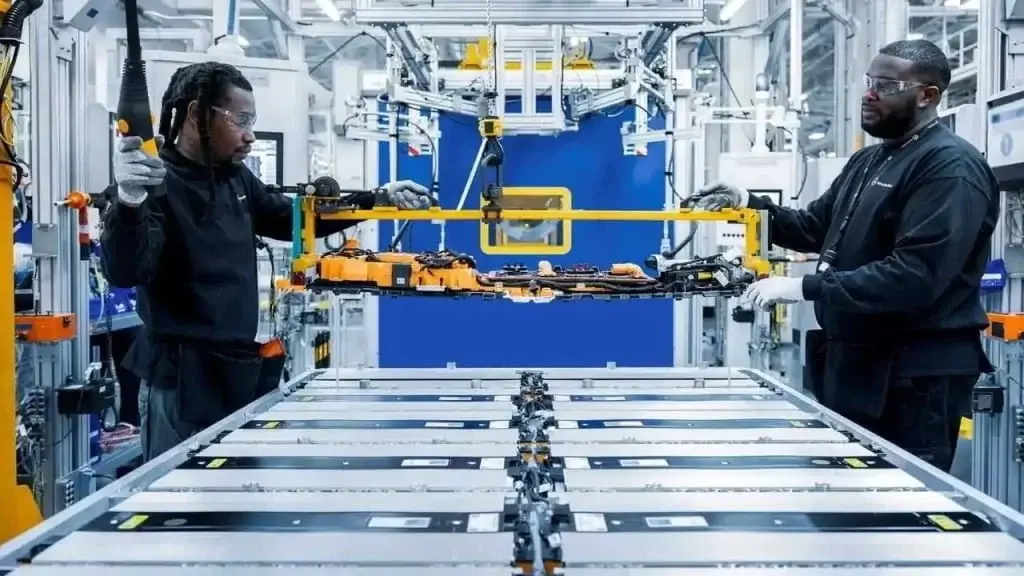

The United States has recently designated $3.5 billion towards the expansion of domestic battery processing facilities. This investment, which is part of the Inflation Reduction Act and the Bipartisan Infrastructure Law, aims to boost the local production of advanced batteries and battery minerals. The objective is to achieve energy independence and advance technological capabilities.

Reducing Dependency on China and South America

At present, the US heavily relies on countries such as China and South America for critical minerals like lithium-ion, which are essential for battery production. This dependence not only poses a strategic risk but also hampers the nation’s ability to lead and innovate in the rapidly evolving electric vehicle (EV) market. By focusing on local production, the US intends to diminish this reliance and establish a strong, self-sufficient battery industry.

Importance of Enhancing Domestic Battery Industry

The global competition for EV dominance is intensifying, with China manufacturing a staggering 75% of the world’s lithium-ion batteries. This places the US at a disadvantage, emphasizing the significance of bolstering the domestic battery industry. Additionally, the Biden administration’s goal of achieving net-zero emissions by 2050, along with the projection that EVs will account for half of all new light-duty vehicle sales by 2030, underscores the urgency of this investment.

Multifaceted Benefits of the Investment

The investment offers several advantages. Firstly, it could significantly enhance the US’s global competitiveness in the clean energy sector. By strengthening the domestic battery industry, the US can position itself as a leader in the field, reducing its dependence on foreign suppliers. Secondly, the expansion of battery processing facilities promises the creation of well-paying jobs, contributing to economic growth. Lastly, this investment aligns with global environmental goals, taking a significant step towards a cleaner and more sustainable future.

Tempering Expectations with Realism

While the investment holds great potential, it is essential to manage expectations realistically. Building an industry, especially one as complex as battery production, takes time and effort. The immediate impact on consumers may be limited, but the long-term benefits could be transformative. It is crucial to understand that the establishment of a robust domestic battery industry is a marathon, not a sprint.

Overall, the allocation of $3.5 billion towards expanding domestic battery processing facilities in the US marks a significant milestone in the pursuit of energy independence and technological advancement. By reducing dependency on foreign suppliers and strengthening the domestic battery industry, the US aims to enhance its global competitiveness, create jobs, and contribute to a cleaner and more sustainable future.

Source: 1