Google is taking legal action against a ruling from the US Consumer Financial Protection Bureau (CFPB) that allows the bureau to “conduct examinations on a periodic basis” to check if Google is following consumer financial regulations.

Allegations Against Google

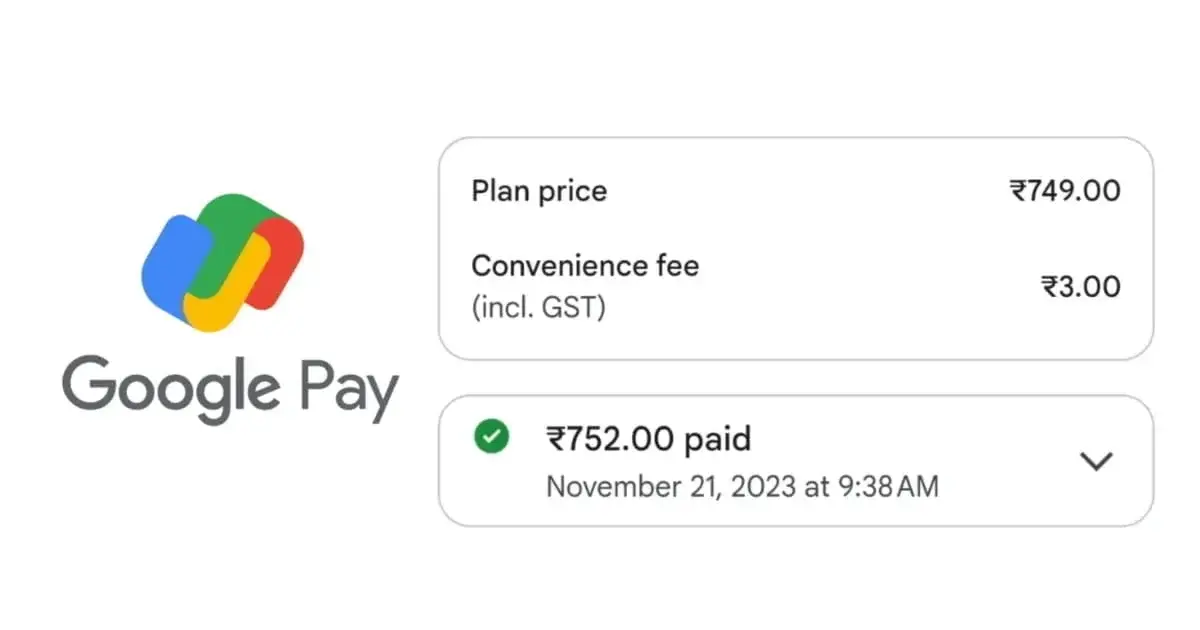

The consumer finance regulator has focused on Google Pay and Google Pay Balance. According to a report published by Engadget, the CFPB stated there was “reasonable cause to determine that Google has engaged in conduct posing risks to consumers.”

It pointed out two main concerns: one related to “allegedly erroneous transactions have posed risks to consumers,” and the other about the “prevention of fraudulent and unauthorized transactions,” which the CFPB claims also posed “risks to consumers.”

Changes in Google Pay Services

The CFPB noted that the Google Pay App was “discontinued” in February 2024, and that the Google Pay Balance platform was “available for limited purposes.” However, this was not sufficient to stop the “designation of Google for supervision, although it may affect whether the CFPB decides to conduct an examination.”

In its lawsuit, Google contended that “a product that no longer exists is incapable of posing such risk.” A spokesperson for the company shared a statement with TechCrunch, saying, “This is a clear case of government overreach involving Google Pay peer-to-peer payments, which never raised risks and is no longer provided in the U.S., and we are challenging it in court.”

Conclusion

The ongoing legal dispute highlights the tension between tech companies and regulatory agencies. As the situation develops, it will be crucial to see how both sides present their arguments and what the outcome will be.