Transsion, known for its brands like Tecno and Infinix, has built a reputation for being quick, adaptable, and innovative in the consumer electronics space. However, it seems the company has made the decision to exit the foldable smartphone arena, indicating that there won’t be a follow-up to its ambitious Phantom V Fold2.

Rumors About a Major Competitor

An even more prominent Chinese company is said to be considering a similar move, as reported by Laifeng.com. While the identity of the company is not disclosed in the report, it’s suggested that they have a series of high-end foldables designed in the same book-style format as the V Fold2.

Possible Implications for Oppo

This unnamed manufacturer could possibly be Oppo, which has also been rumored to have scrapped the successor to its smaller foldable, the clamshell-type Find N3 Flip. This mirrors a similar choice made by its sister brand, Vivo, regarding the X Flip 2.

However, Oppo is still active in the flagship foldable market with its Find N3, also referred to as the OnePlus Open. This device stands as a key competitor against the likes of Google Pixel Fold and Samsung Galaxy Z Fold series on platforms like Amazon.

Future Prospects and Market Dynamics

The second generation of Oppo’s foldable is expected to improve significantly, boasting features like magnetic wireless charging, a more expansive main flexible OLED display, and the same Snapdragon 8 Elite chipset found in the brand’s current flagship smartphone.

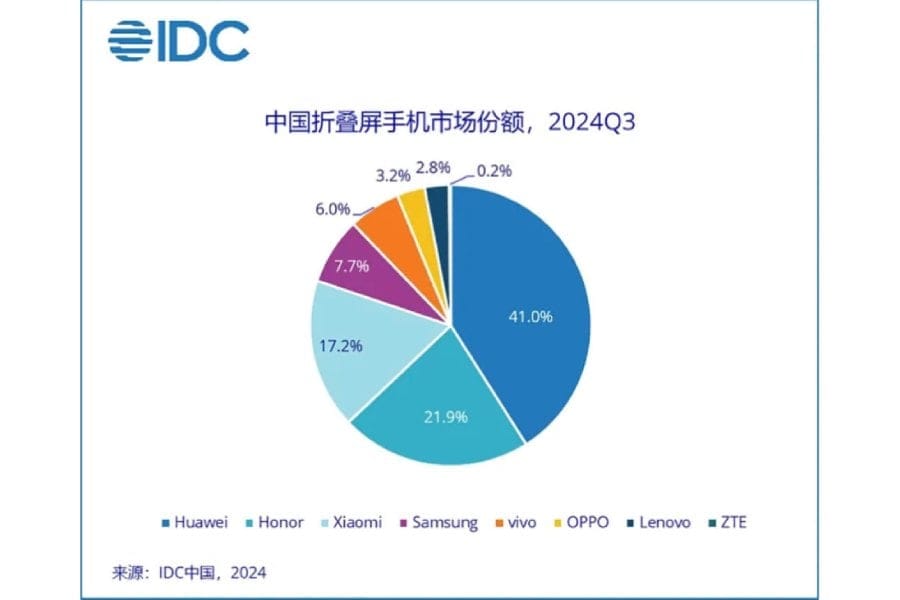

The foldable device market can be quite unstable, as evidenced by Xiaomi’s declining sales of its premium 4th-gen Mix Fold, in contrast to the success of its first-gen Mix Flip clamshell, which is anticipated to achieve shipments nearly five times greater than the Fold 4 in China by year-end.

In conclusion, the unexpected absence of the Open 2 (or 3) could negatively affect the international market. This would leave its few competitors with less motivation to enhance the capabilities introduced by its first iteration, which included a more “normal-sized” cover display, faster charging, potentially improved Open Canvas multitasking, and a full-sized Hasselblad-branded camera bump.