Key Takeaways

1. OnePlus is launching the OnePlus 13T, a compact flagship smartphone, in China, with plans to potentially introduce it in India.

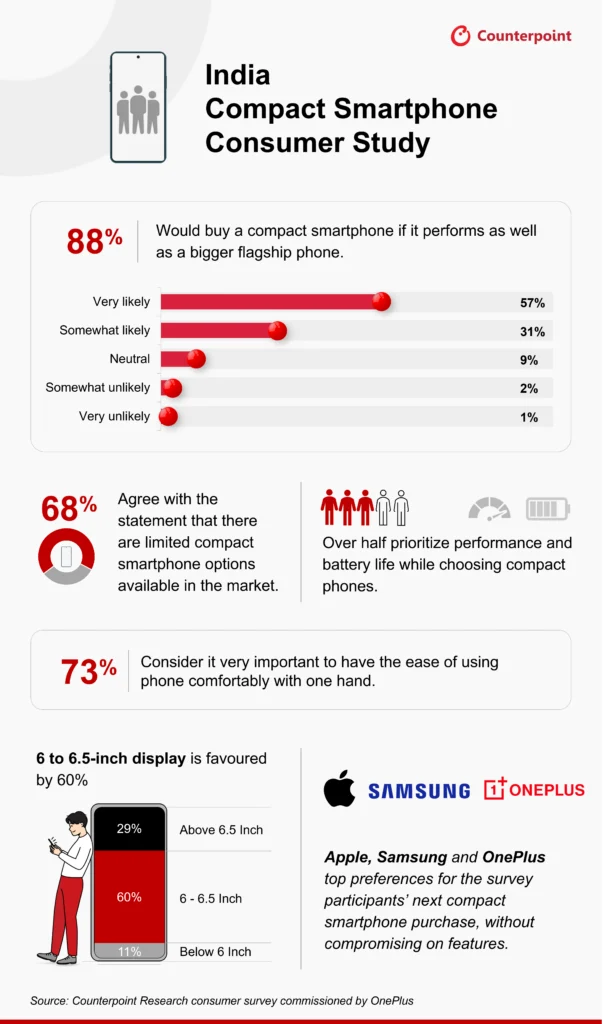

2. A Counterpoint Research survey reveals 74% of Indian consumers prefer smaller smartphones, highlighting a demand for compact flagships.

3. Usability is crucial, with 73% of respondents prioritizing one-handed operation and comfort in their smartphone design preferences.

4. The OnePlus 13T features a 6.32-inch display, Snapdragon 8 Elite SoC, 50MP main camera, and a 6260mAh battery with 80W fast charging.

5. The device is designed for performance and comfort, addressing the gap in the market for high-performance compact smartphones.

OnePlus is set to launch the OnePlus 13T, a small flagship smartphone, in China today. It seems the company is also thinking about bringing this compact device to India. This idea comes from a recent survey by Counterpoint Research, which was commissioned by OnePlus, indicating that there is a demand for a compact flagship from the brand.

Rising Interest in Compact Flagships

The survey conducted by Counterpoint Research shows that there is an increasing interest among Indian consumers for a compact flagship smartphone from OnePlus. It turns out that 74% of people surveyed prefer smaller smartphones, while 68% think there are not enough choices in this area. Consumers are eager for high-performance capabilities in smaller devices, with 88% ready to buy a compact phone if it features a powerful processor and a long-lasting battery. OnePlus, being a popular brand for future compact smartphone purchases, seems to be in a good position to cater to this need.

Usability and Design Preferences

The survey further emphasizes how important usability is, with 73% of respondents highlighting the need for one-handed operation and comfort, making a compact design crucial. The preferred screen size for 60% of those surveyed falls between 6 to 6.5 inches. Furthermore, as mobile gaming becomes more popular and AI-powered features gain traction, OnePlus has a significant opportunity to present a compact flagship that brings together performance, ease of use, and long-term comfort—addressing a clear void in today’s smartphone market.

Specifications of the OnePlus 13T

The OnePlus 13T, launching in China, boasts a 6.32-inch, 2640 x 1216p 1.5K LTPO display with a flat design. Under the hood, it runs on the Snapdragon 8 Elite SoC and features a 50-megapixel IMX906 OIS main camera, along with a 50-megapixel 2X telephoto lens. The device packs a 6260mAh battery and supports 80W fast charging. With a metal frame, glass body, optical under-screen fingerprint sensor, and 0809 X-axis motor, it weighs 185g and is rated IP65 for both water and dust resistance.